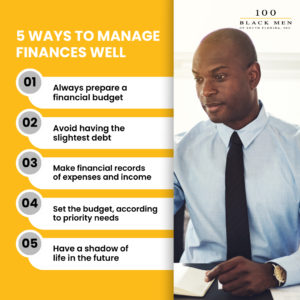

- Always Prepare a Financial Budget: Plan your spending and savings with a detailed budget.

- Avoid Having Any Debt: Minimize debt to maintain financial stability and reduce interest costs.

- Keep Financial Records: Track your expenses and income to maintain financial awareness.

- Prioritize Your Budget: Allocate funds based on essential needs and long-term goals.

- Plan for the Future: Establish savings and investments for a secure and fulfilling future.

Managing finances effectively is key to financial health and stability. Take control of your financial journey with these practical tips!